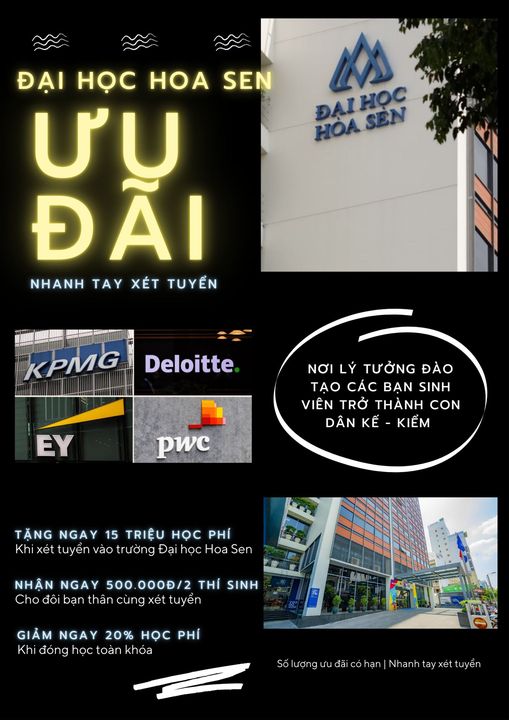

[ADMISSION ??? ???] ACCOUNTING MAJOR

06/02/2024

Professional Attitude and Ethics

- Comply with the ethical standards of accounting and auditing professions: Must perform accounting and auditing tasks according to the techniques and professional standards specified in the accounting standards, Vietnamese auditing standards, regulations of professional associations, and current laws.

- Comply with the internal regulations and discipline of the enterprise and the laws of the state.

Professional Competence

- Evaluate and propose appropriate business strategies in line with the micro and macroeconomic policies of the state.

- Carry out financial accounting tasks: complete the main accounting tasks in the enterprise from detailed accounting to general accounting, including preparing documents, recording accounting entries, and preparing accounting reports.

- Perform management accounting tasks: classify and manage costs, analyze the cost-volume-profit relationship, prepare budgets, evaluate business efficiency, analyze profit fluctuations, and use appropriate information to choose business strategies.

- Prepare financial reports, audit reports, and tax reports in accordance with the regulations of the accounting, auditing, and tax legal system of Vietnam and international standards.

- Analyze financial reports, management accounting reports, and audit reports to evaluate the efficiency of capital and assets utilization, develop financial plans, forecast risks, and make appropriate investment decisions and business strategies for the enterprise.

- Establish internal control procedures (control of short-term assets, long-term assets, liabilities, revenue, expenses, etc.) and audit the items in the financial reports.

- Have the ability to analyze, evaluate, and implement solutions to organize and improve the financial accounting information system, management accounting system, and internal control system of the enterprise.

- Prepare and evaluate the effectiveness of investment projects for small and medium-sized enterprises.

- Have proficient computer skills, be able to organize accounting databases, and use application software for accounting, auditing, and financial tasks.

Integration and Lifelong Learning Ability

- Organize financial accounting information system, management accounting system, and internal control system suitable for the scale and field of operation of the enterprise, providing appropriate information for timely and effective business inspection, evaluation, and decision-making.

- Have TOEIC certificate with a score of 550, be able to use Vietnamese and English in accounting, auditing, finance, tax, and research specialized documents.

- Have the ability to cooperate and assign accounting, auditing, tax, and financial tasks to members of the department and departments in the enterprise.

- Have the ability to collect and process information, apply new methods and current regulations in the fields of accounting, auditing, tax, and finance in Vietnam and internationally.

- Have a passion for and strive to develop the profession, participate in activities of professional organizations, and strive to achieve valuable professional certificates both domestically and internationally, such as CPA, ACCA, Tax Professional Certificate, etc.

- Participate in preserving and protecting the ecological environment.

- Respect diversity in a multicultural environment, be proactive, and make efforts to improve the working environment in a positive direction.

For more information, please visit: https://www.hoasen.edu.vn/tcnh/education/ke-toan/

——————————————–

Faculty of finance and banking

Website: https://www.hoasen.edu.vn/tcnh/

Email: khoatcnh@hoasen.edu.vn