Trade terms DAT/DAP/DDP In Air Transport

The letter D comes from the word “Delivered” in the term D group of conditions when transporting goods by air, showing that this is a group of terms that stipulates that the seller fulfills his obligations when he has delivered the goods to the buyer. at the final destination as specified. Through the article with the topic “Learning about DAT/DAP/DDP conditions in air transport”, the Faculty of Logistics and International Trade will join readers in decoding the responsibilities and costs between the seller and the buyer as well as such as determining the location of risk transfer when transporting goods by air according to commercial terms DAT/DAP/DDP. Let’s start!

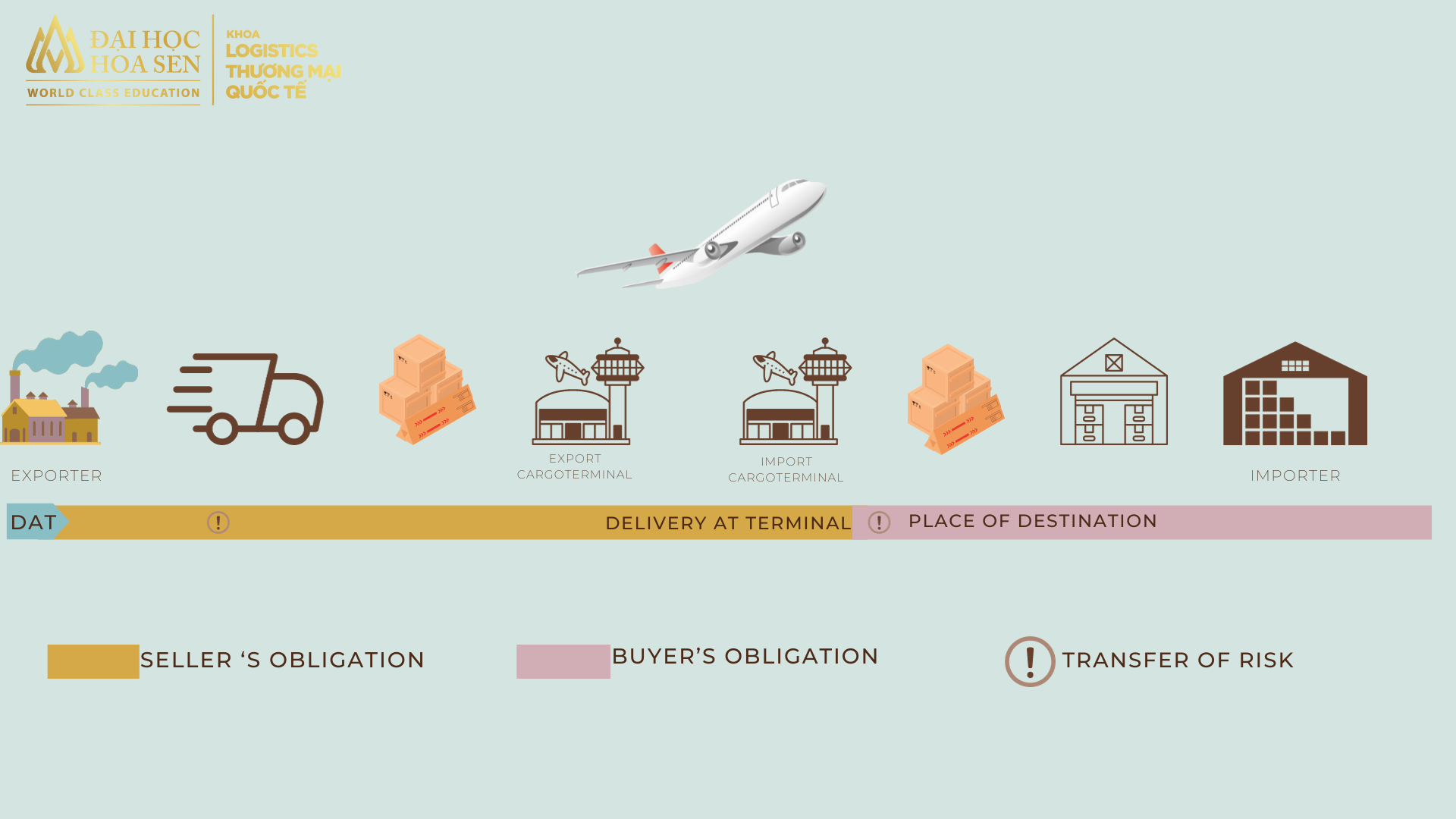

DAT conditions – Delivered at terminal

DAT (Delivered at Terminal) – Delivered at the terminal. In air transport, the “Terminal” here is the cargo terminal (Air cargo Terminal). The cargo terminal can be understood as a transit HUB that every individual/unit sending/receiving goods via air needs to go to. This is where the flow of goods into/out of the airport will be handled, ensuring security and aviation safety. Some cargo terminals in Vietnam include SCSC warehouse, TCS warehouse (belonging to Tan Son Nhat international airport); NTCS, ACSV and ALSC warehouses (belonging to Noi Bai international airport)

According to DAT delivery terms, the seller needs to:

Prepare goods fully in accordance with the provisions of the Commercial Contract

Complete the loading of goods onto domestic transport vehicles (trucks) as well as carry out export customs clearance procedures and bear all costs of export customs clearance.

The seller must hire an inland transport vehicle to transport the goods to the cargo terminal/airport and bear all risks and losses of the goods before the goods are delivered to the first carrier.

Regarding cost responsibility, the seller will pay local charges at the departure airport, arrival airport and pay air freight from the export airport to the import airport.

***Point of transfer of risk: For goods transported by air under DAT, the seller’s goods obligations end when the goods are safely unloaded from the cargo aircraft at the destination airport.

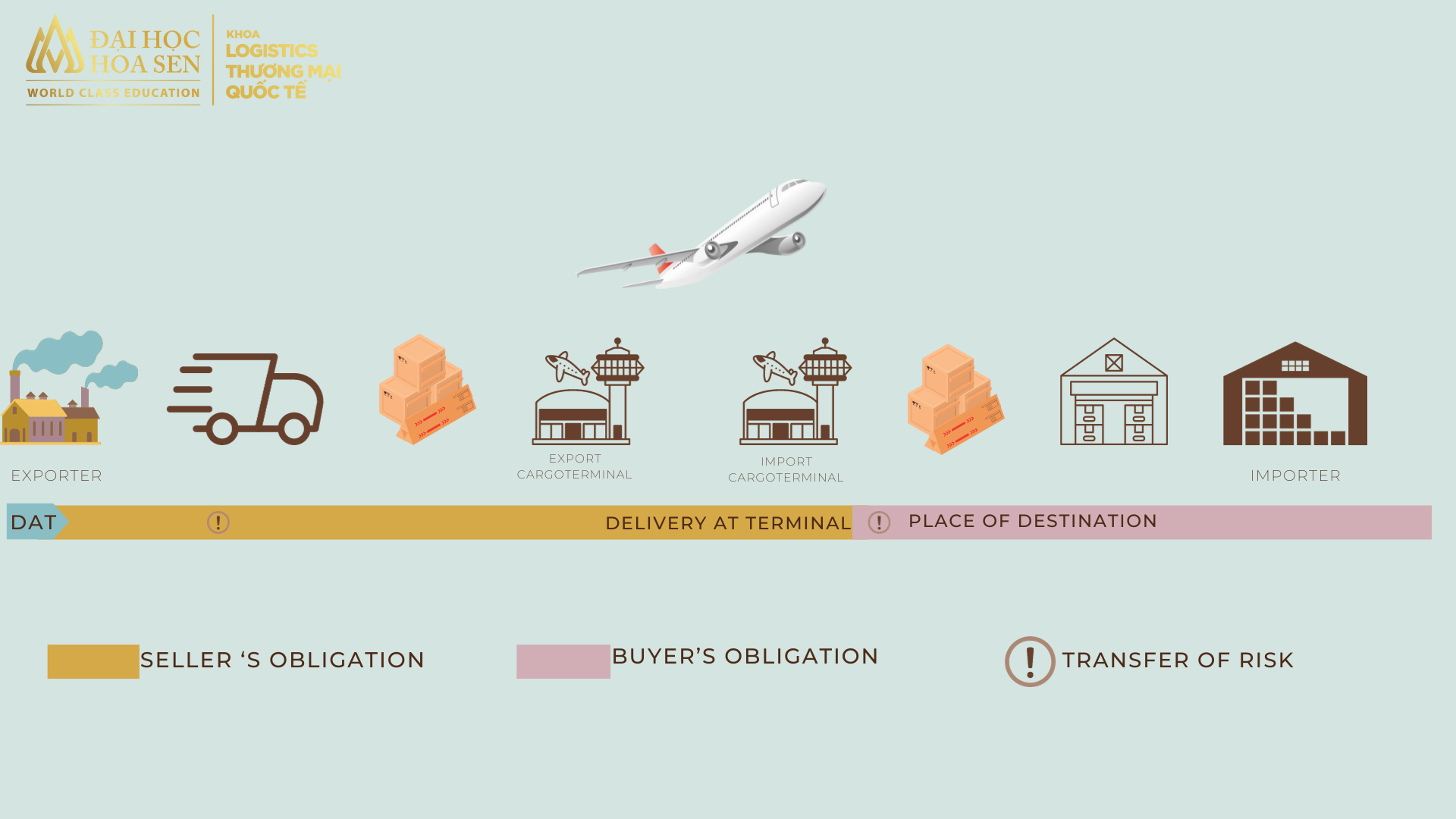

DAP conditions – Delivery at destination

DAP is one of the conditions of the system of incoterms. DAP stands for Delivery at Place, meaning delivery at destination. With this condition, the seller will bear all costs and risks incurred to bring the goods to the designated destination, so when entering into a contract, the parties should clearly stipulate the specific location at the destination.

While in DAT terms the seller’s responsibility for the goods is complete when the goods are safely unloaded from the cargo aircraft at the destination airport then in DAP the incoterm emphasizes the fact that the destination location can be anywhere not just “port, wharf, terminal”. However, if that point is not the port of entry airport, the seller must ensure that the delivery location is a location where he/she is capable of unloading the goods.

The seller’s responsibilities under DAP are similar to those of DAT.

***Point of transfer of risk: For goods transported by air under DAP conditions, the seller’s goods obligations end when the goods are safely unloaded at any place agreed by the buyer and seller.

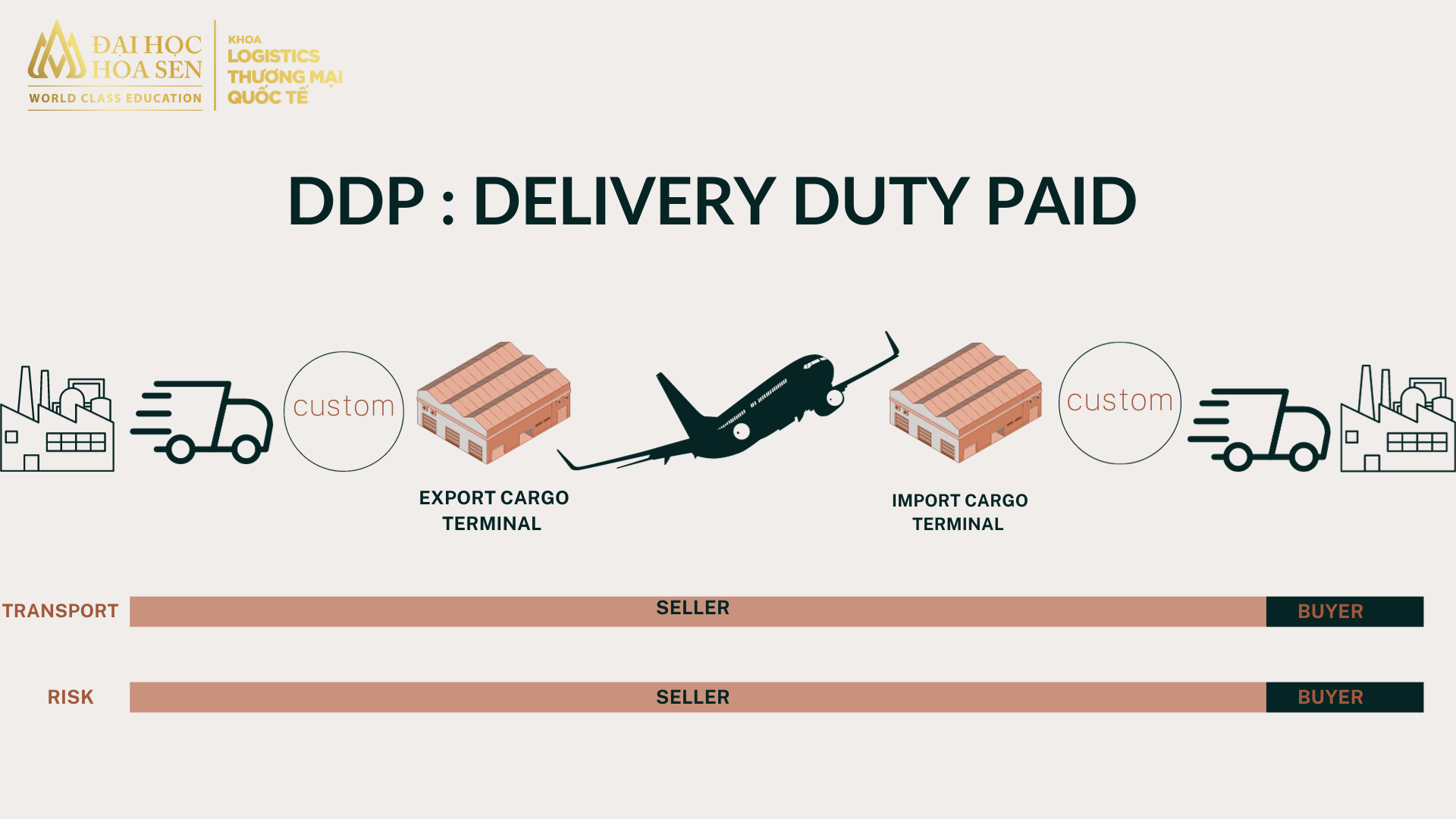

DDP conditions – Delivered with tax paid or Delivered with import and export customs clearance

DDP (Delivered Duty Paid) terms – Delivery cleared for import, means the seller delivers when the goods are placed at the disposal of the buyer, cleared for import, on the arriving means of transport. and ready for unloading at the named place of destination.

The seller bears all costs and risks involved in bringing the goods to the destination and is obliged to clear the goods, not only for export but also for import, pay taxes, fees and carry out other formalities. procedures for export customs clearance and import customs clearance.

Note for exporters: The exporter will bear the highest level of obligations when using DDP terms in sales transactions, not only must the seller be responsible for shipping and delivery, but the seller must also clear customs and pay taxes. import tax or VAT and any other taxes must be paid when carrying out import procedures unless otherwise specified by both parties.

***Risk transfer point: For goods transported by air under DDP conditions, the seller’s goods obligations end when the goods are cleared for import, and successfully and safely transported to their destination. Receive specified goods. The specified place of receipt is usually the buyer’s warehouse in the importing country.

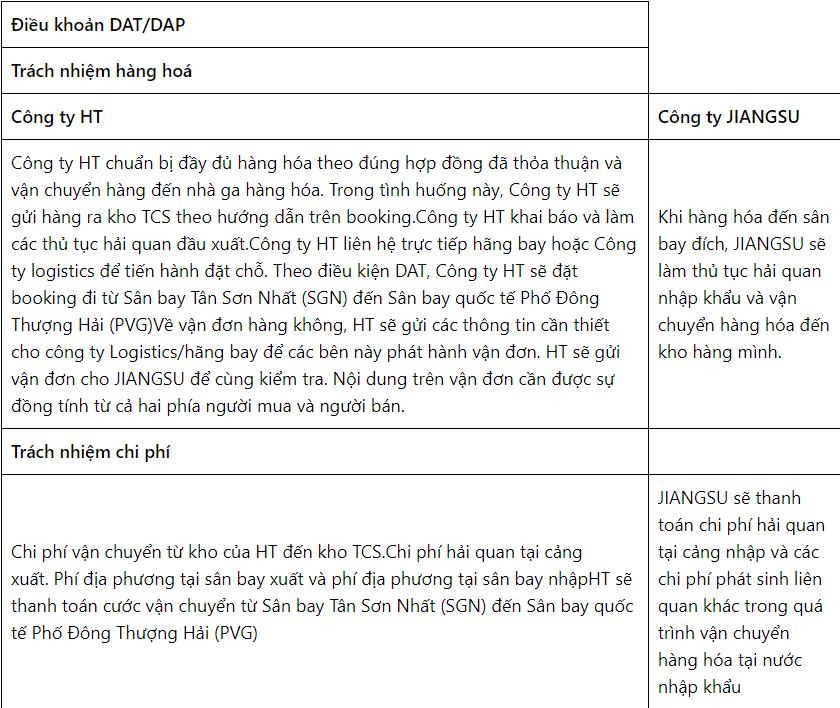

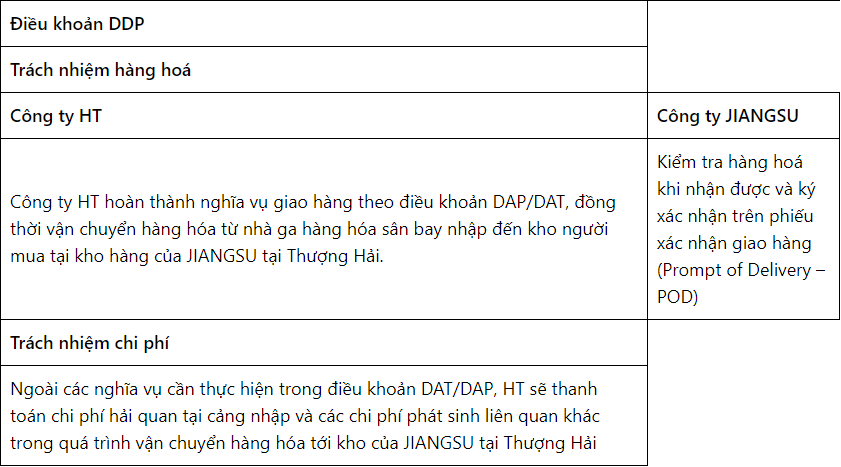

Illustrative example

HT Company exported a shipment of 4 pallets of rolled copper wire fabric from Tan Son Nhat International Airport (SGN) to Shanghai Pudong International Airport (PVG) respectively under DAT/DAP/DDU terms for the Company. JIANGSU company in Shanghai city. Pallet sizes are: 1407250 cm/1plt; 1407950cm/2plt; 927950cm/1plt with total weight of 1131 Kgs. The invoice value of the shipment is 2,545 USD.

Below is the allocation of goods responsibilities and costs when HT Company exports goods to JIANGSU Company by air under DAT/DAP/DDU

The illustration above also ends this article. The Faculty of Logistics and International Trade hopes that readers will find useful and necessary information to expand their knowledge and apply it to their current work!